FINQ Guard – Real-Time Fraud Monitoring

Effortless Fraud Detection in a Digital World

With FINQ Guard, financial institutions can identify, investigate, and prevent fraudulent activities in real-time. Our advanced Transaction Monitoring module supports multiple formats, including ISO 20022, and empowers non-technical users with an intuitive Visual Rule Builder. Fraudulent transactions are instantly flagged and routed to a dedicated Compliance Workspace, ensuring efficient investigation, resolution, and regulatory compliance.

Inspect. Detect. Prevent.

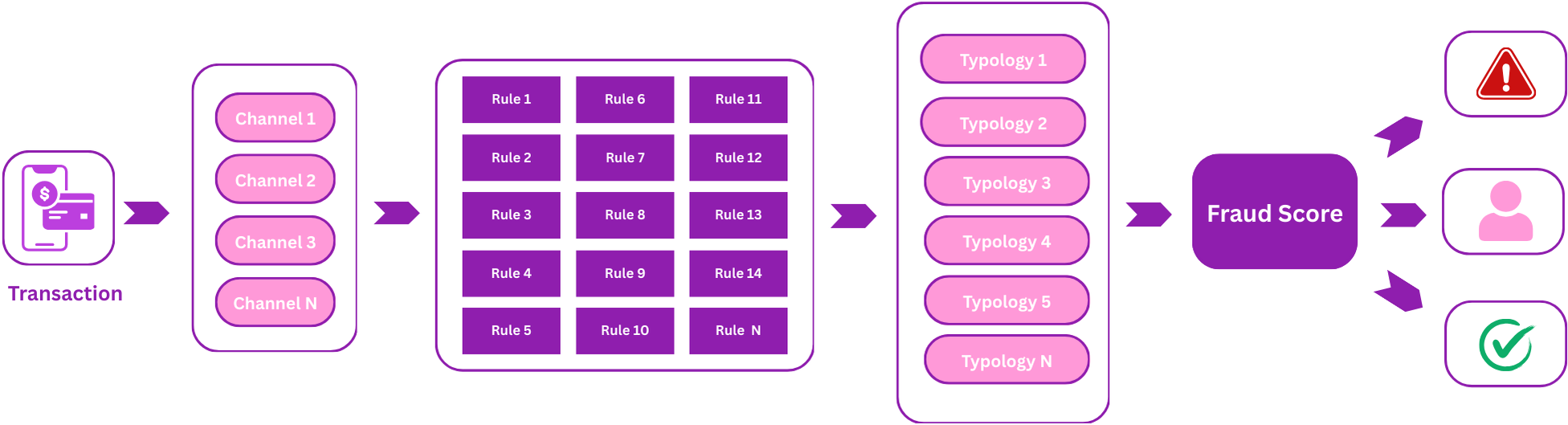

Built on Tazama’s open-source engine, FINQ Guard analyzes transactions across multiple banking channels—online, mobile, ATM, and in-branch. It applies preconfigured typologies and customizable rules to detect anomalies such as unusual transaction amounts, high-risk geographies, or suspicious behavioral patterns.

Why It Works – A Powerful, Adaptable Fraud Prevention Tool

User-Driven Configuration

Update detection rules instantly using the Configuration Manager—no developer needed. Quickly adapt to evolving fraud patterns.

Compliance Workspace

All alerts are routed to a streamlined case management hub for rapid investigation, escalation, and resolution.

Powered by Tazama

Leverages the scalability and transparency of an open-source engine, constantly improving through community innovation.

ISO 20022 & Beyond

Fully compatible with international transaction standards, making it ideal for global operations.

Key Features

Benefits

Use Cases

Why Choose Algoqube

At Algoqube, we don’t just provide a fraud monitoring platform—we deliver end-to-end value:

- Tailored Deployment – On-premises, cloud, or hybrid based on client needs.

- Seamless Integration – Works with CRMs, payment platforms, and compliance systems.

- Expert Support – Backed by our deep expertise in payments, compliance, and fraud management.

- Continuous Innovation – Regular updates to address new and emerging fraud trends.

Book a Demo Today

Contact Algoqube to explore how our real-time fraud monitoring solution can strengthen your defenses against financial crime.